The History of Rolex Watches: A Collector's Guide

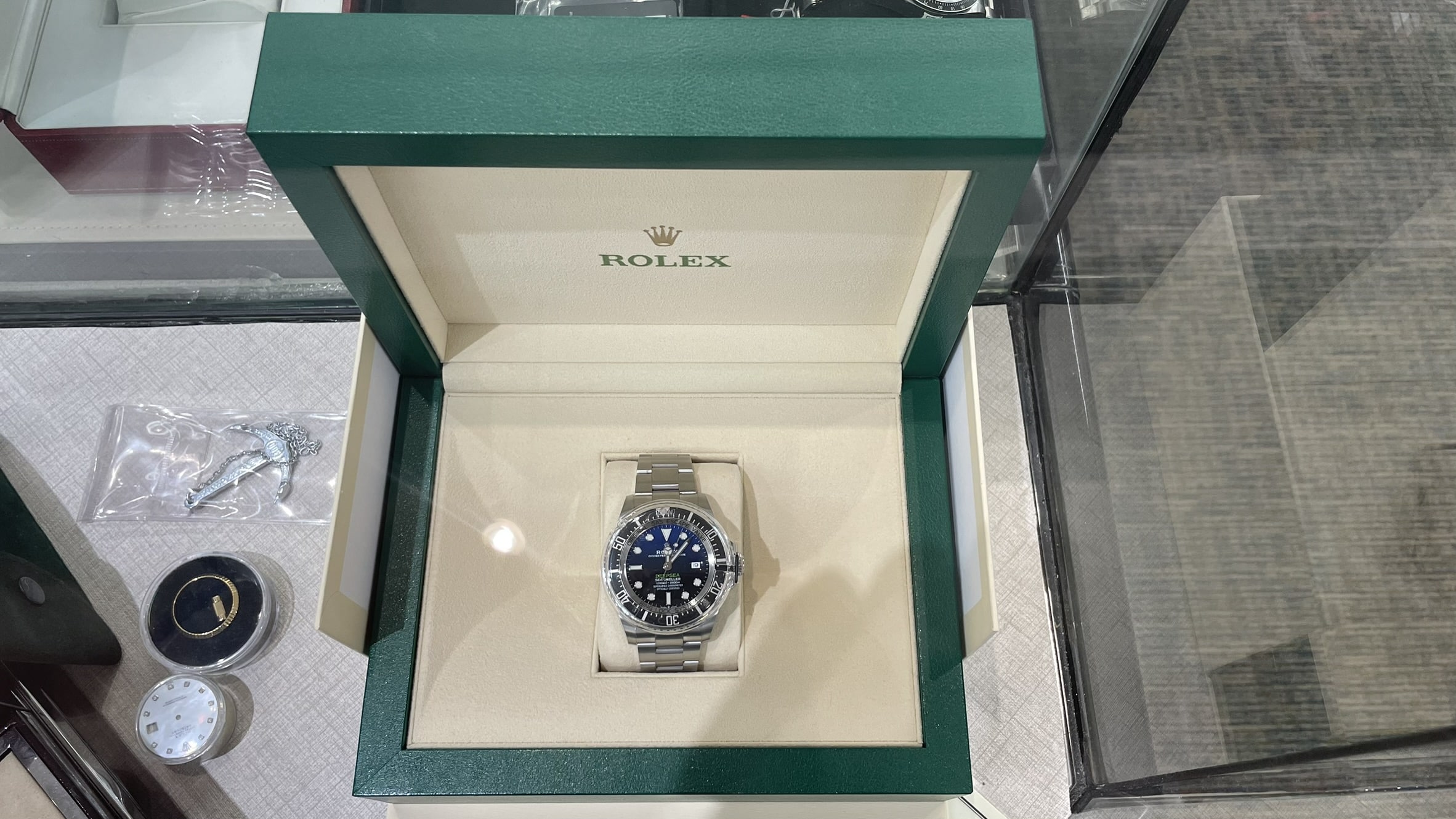

Our Rolex Gallery

The Origins of Rolex's Secondary Market Appeal

These early technical achievements laid the foundation for Rolex’s reputation for creating timepieces that could withstand extreme conditions while maintaining exceptional accuracy. This durability factor became crucial to the eventual development of a robust secondary market, as Rolex watches could genuinely be passed down through generations while remaining functional and relevant.

The Birth of Tool Watches and Their Legacy

The Submariner (1953)

The GMT-Master (1955)

The Daytona (1963)

The 1970s to the Internet Era

The 1970s and 1980s: Crisis and Renaissance

During this period, sports models continued to evolve with incremental improvements rather than radical redesigns—a consistency that would later contribute to their collectibility. The relative affordability of Rolex watches during this era (compared to today’s prices) meant that many were worn regularly rather than preserved, making well-maintained examples from this period increasingly rare and valuable.

The Transition to Luxury Status

The introduction of more elaborate models like the two-tone “Rolesor” variations and the prestigious solid gold Day-Date “President” expanded Rolex’s appeal beyond tool watch enthusiasts. The secondary market began to develop more sophisticated pricing structures based on condition, originality, and the presence of original packaging and documentation.

The Internet Era and Market Maturation

Specialized forums and websites dedicated to vintage Rolex collecting emerged, creating communities where knowledge about minuscule details—like the shape of a serif on a dial or the specific patina pattern on tritium hour markers—became crucial factors in determining authenticity and value.

Models That Have Retained Value Best

Certain Rolex models have demonstrated exceptional value retention and appreciation in the secondary market:

Stainless Steel Daytona

GMT-Master "Pepsi" and "Batman"

Submariner "Hulk" and "Kermit"

Explorer II Reference 16550

The short-lived Explorer II reference 16550 from the 1980s has become highly collectible due to a manufacturing quirk that caused some white dials to patina to a cream “ivory” color over time, creating an unintended and rare variation highly prized by collectors.

Vintage Sea-Dweller and Submariner

Early Sea-Dweller models, particularly the “Double Red” Sea-Dweller (DRSD) and first-generation Submariners with gilt (gold) text dials and no crown guards have proven to be extraordinary investments, increasing in value by orders of magnitude over decades.

Factors and Trends

Factors Driving Value in Pre-owned Rolex Watches

Several key factors determine value retention and appreciation potential in the pre-owned Rolex market:

Rarity and Production Numbers

Limited production models naturally command higher premiums. Rolex rarely discloses exact production figures, but models known to have shorter production runs (like the Submariner reference 1680 with red text) typically appreciate faster than standard productions.

Condition and Originality

Collectors place enormous value on original, unpolished cases with sharp edges and factory finishes. Similarly, original dials without restoration work and original, matching lume material dramatically affect value. A completely original example can sell for multiples of what an otherwise identical but refinished watch might bring.

Complete Sets and Provenance

The presence of original boxes, papers, warranty cards, hang tags, and purchase receipts can increase value by 15-30% compared to the “watch only” equivalent. Watches with interesting provenance—previous celebrity ownership or historical significance—can command extraordinary premiums.

Discontinued Models

When Rolex discontinues a particular reference, secondary market prices often surge as collectors scramble to acquire the last examples of that design. This pattern has repeated consistently with models like the Submariner “Hulk” and various GMT-Master references.

Subtle Variations

The pre-owned Rolex market places enormous value on subtle dial variations, bezel types, and production quirks. For example, Submariner dials with depth ratings where “meters” appears before “feet” (“meters first” dials) or Explorer references with exclamation point markers can command significant premiums over standard variants.

Modern Trends and Market Dynamics

The contemporary pre-owned Rolex market has developed several distinctive characteristics:

The “Grey Market” Premium

For many desirable stainless steel sports models like the Daytona, GMT-Master II, and Submariner, authorized dealers maintain lengthy waiting lists, creating a situation where brand new watches immediately sell above retail in the secondary (or “grey”) market. This unusual dynamic has transformed Rolex’s most popular models into instant investments for those able to purchase at retail.

Investment-Grade Vintage Models

Certain vintage references, particularly from the 1950s through 1970s, have transcended mere collectible status to become legitimate investment assets. These watches are sometimes purchased purely for their appreciation potential rather than to be worn, with condition and originality being paramount considerations.

The Rise of Neo-Vintage

Watches from the 1980s and 1990s—once considered merely “used”—have now entered what collectors term the “neo-vintage” category. Models like the Submariner reference 16800 with tritium dials or early Explorer II reference 16570 watches have seen rapid appreciation as they represent the last generation of Rolex models with vintage characteristics like tritium luminous material and aluminum bezels.

Market Corrections and Stability

While the overall trajectory of rare Rolex models has been upward, the market does experience corrections. The most significant recent adjustment occurred in 2022-2023 when prices for many contemporary models declined from their post-pandemic peaks. However, truly rare vintage pieces have demonstrated remarkable stability even during broader market downturns.